OSS, Netherlands, 24 April 2024 – Flindr Therapeutics B.V. (“Flindr” or “the Company”), a precision oncology therapeutics company, today announces a €20 million Series A financing to advance its pipeline of first-in-class, small molecule inhibitors for treatment of cancer. V-Bio Ventures led the financing alongside other new investors Johnson & Johnson Innovation – JJDC, Inc. (JJDC), QBIC Fund, Flanders Future Tech Fund and Curie Capital, as well as existing investors Oncode Oncology Bridge Fund, Swanbridge and Brabantse Ontwikkelings Maatschappij (BOM).

Flindr combines world class science and expertise in translational biology, cancer target identification, immuno-oncology and small molecule oncology drug development. The expert team has a successful track record in the identification and development of covalent small molecules inhibitors from discovery to market approval.

The Company utilizes the “ImmunoGram Drug Discovery Engine”, which has evolved from seminal work in the laboratories of the Netherlands Cancer Institute (NKI) and the Oncode Institute. This approach involves reverse-translating the heterogeneity in tumor-specific and host-specific factors, as commonly seen in patients in the clinic, into lab-based biological models to screen for and select the most important drug targets involved in patient clinical response.

Flindr’s lead program is a first-in-class small molecule inhibitor of RNF31 (also known as HOIP), a protein-stabilizing E3 ubiquitin ligase which is aberrantly activated in solid and hematological malignancies. The Company has already obtained highly promising activity for the drug candidate in preclinical ovarian cancer and B-cell lymphoma models, and identified biomarkers which will help select patients most likely to respond to treatment with RNF31 inhibitors. Flindr will use the funds to progress its lead program to IND, develop an exciting second program, and broaden its pipeline using the ImmunoGram Drug Discovery Engine.

Flindr Therapeutics was created in 2020, with Maarten Ligtenberg as the founding CEO, and initial seed financing from Oncode Oncology Bridge Fund, Swanbridge Capital and Innovatiefonds Noord Holland. In 2023, Flindr joined forces with VIB, Flanders’ leading life sciences research institute, and the lab of Professor Rudi Beyaert (of the VIB-UGent Center for Inflammation Research), to leverage their deep expertise of immunology – including RNF31 biology – and development of animal cancer models. Their work with Flindr in these areas will provide further validation of RNF31 as a target and will enable the Company to make safety predictions.

Maarten Ligtenberg, PhD, Chief Executive Officer and Founder at Flindr, said: “This €20 million Series A financing will help us translate our precision targets into precision therapies, with the ultimate goal of potentially transforming the lives of patients with cancer. The backing of this highly regarded investor syndicate is a strong validation of our unique approach and the potential of our pipeline.”

Christina Takke, Managing Partner at V-Bio Ventures, commented: “We strongly believe that a complementary team is crucial for any success. The Flindr team combines well-established identification expertise from the NKI with world class biological insights from VIB, and its deep experience and successful track record in the identification and development of covalent small molecules inhibitors.”

Following financing, the Flindr Supervisory Board of Directors will include Christina Takke, V-Bio Ventures, Chris De Jonghe, Oncode Institute, Tine Bekaert, Flanders Future Tech Fund, Cedric van Nevel, QBIC Fund and Allard Kaptein, CEO of Genase Therapeutics and Chief Strategy Officer of IMMIOS, as well as a representative of JJDC.

V-Bio Ventures

Christina Takke

Email: christina.takke@v-bio.ventures

Flindr Therapeutics

Ernst Geutjes, PhD

Chief Business Officer

Email: e.geutjes@flindrtx.com

Flindr Therapeutics, based in Oss in the Netherlands, is a private pre-clinical biotech company developing next-generation precision oncology treatments. The Company, previously called Immagene, was spun out of the Netherlands Cancer Institute (NKI) and Oncode Institute in 2020, by founders Prof Daniel Peeper, Prof Christian Blank and Dr Maarten Ligtenberg. Flindr is actively building a pipeline of highly promising, first-in-class precision oncology therapies identified through the ImmunoGram Drug Discovery Engine. It is backed by V-Bio Ventures, Johnson & Johnson Innovation – JJDC, Inc., QBIC Fund, Flanders Future Tech Fund, Curie Capital, Oncode Oncology Bridge Fund, Swanbridge, Innovatiefonds Noord Holland, and BOM. Flindr has entered into a research collaboration with the NKI, and the VIB (Flanders Institute of Biotechnology).

V-Bio Ventures (www.v-bio.ventures) is an independent venture capital firm specialized in financing and supporting innovative life sciences companies. V-Bio Ventures was founded in 2015 and works closely with Belgium-based VIB, one of the world’s leading research institutes in the life sciences. The fund invests across Europe in high growth potential start-ups and young companies targeting transformational innovations in the biotech, pharmaceutical and agricultural sectors.

The pursuit of scientific knowledge is at the heart of human progress – it leads to ground-breaking discoveries that have transformed our understanding of the world and our place within it. However, this noble pursuit is not without its blemishes. Scientific fraud – the deliberate misrepresentation of data or results to deceive the scientific community – poses a serious threat to the integrity of the scientific enterprise in both academia and industry. So, what can we do about it?

Troubling examples of worldwide fraud

Recent revelations of widespread fraud at the Dana-Farber Cancer Institute have sent shockwaves through the scientific community. The prestigious Boston institute will retract six studies and correct 31 more as part of an ongoing investigation into claims of data manipulation. That these issues have come to light at such a highly respected research institution has raised concerns about the pervasiveness of the problem of scientific fraud.

The Dana-Farber controversy arose after allegations were made by the British molecular biologist Sholto David. In January 2024, he published a blog post suggesting researchers involved in several specific studies had committed scientific fraud, including data fabrication, image manipulation, and falsification of results. Unfortunately, the Dana-Farber institute is not an isolated case. In early February 2024, microbiologist and science integrity consultant Elisabeth Bik published the results of her latest investigation into alleged scientific misconduct. Her report outlined 59 instances of alleged image duplication or reuse in papers published by Khalid Shah, a neuroscientist at Harvard Medical School and its teaching hospital, Brigham and Women’s Hospital.

These two incidents are just a few recent high-profile examples illustrating an underlying problem in academia. Over the past decade, the number of research misconduct allegations reported to the National Institutes of Health (NIH – the primary US agency for biomedical and public health research) has more than doubled, climbing from 74 in 2013 to 169 in 2022. In China, the government has launched a nationwide self-review of university publications after it became known that Hindawi (a London-based subsidiary of the publisher Wiley) retracted a significant number of articles, including 9,600 in 2023 of which the vast majority (about 8,200) had at least one co-author in China. It is clear that we are currently seeing the tip of the iceberg of a deep-rooted issue in global academic publishing, made worse by the “publish or perish” culture that is rife within academic careers.

Erosion of trust

One concerning consequence of research fraud is the erosion of public trust in science. When researchers are found to have fabricated data or manipulated experiments, it undermines the credibility of the entire scientific community. This can lead to skepticism about the validity of scientific findings, making it more difficult to disseminate important scientific information to the public. It also contributes to the spread conspiracy theories, such as the viral misinformation spread during the COVID-19 pandemic.

“When researchers are found to have fabricated data or manipulated experiments, it undermines the credibility of the entire scientific community.” – Katja Rosenkranz

The ramifications of scientific fraud also extend beyond the public perception of tarnished researcher reputations. For biotech companies, the consequences can be particularly severe, as they rely on scientific research to develop new drugs and therapies. When fraud is discovered in research conducted at a company’s partner institution, it can cast doubt on the validity of the entire research portfolio, jeopardizing ongoing clinical trials and delaying, or even halting, drug development. This can lead to significant financial losses for the company and negatively impact its prospects of future funding.

Moreover, fraud can raise concerns about the company’s commitment to ethical practices and may damage its relationships with regulators and the public. The fallout from scientific fraud can be long-lasting, affecting a company’s reputation and ability to operate effectively in the highly-regulated biotech industry. At a time when conspiracy theories are rife – including examples like “covid vaccines spread the disease” or “vaccines are an attempt by governments to restrict free speech” – the erosion of trust in the integrity of the biotech and pharma industry can be highly damaging to both companies and public health.

Protecting scientific integrity

Addressing the issue of scientific fraud requires a multifaceted approach involving researchers, institutions, and funding agencies. Venture Capitalist funds also play a vital part, as they finance start-ups which are often developing new therapies or inventions originating in the academic labs of scientific institutions.

As VCs, we often ask for data to be reproduced by external service providers, either before we invest or as a first step after an investment. This is done not only to screen for potential fraud, but also because many academic experiments can’t be reproduced in other labs, which can occur due to many reasons other than fraud. The aim for both is to ensure that the scientific basis of the company is sound.

To combat scientific fraud and its severe negative consequences, all stakeholders in the scientific community must foster a culture of openness and accountability, where researchers are encouraged to report concerns about misconduct without fear of reprisal. This requires a supportive environment where transparency and collaboration are valued. At V-Bio Ventures we call on all VCs to do their part in ensuring that their portfolio companies are based on a solid foundation, and that the highest standards of scientific integrity are upheld.

“To combat scientific fraud and its severe negative consequences, all stakeholders in the scientific community must foster a culture of openness and accountability.” – Katja Rosenkranz

Antibiotic resistance is a major concern for humans and animals. Increasing pressure to move away from antibiotics has created space for new solutions for disease management. Animab’s oral monoclonal antibody platform is a promising alternative, effectively guarding against infection during a vulnerable period in an animal’s development.

Antibiotic-resistant pathogens have become more common in the last decades, which can cause difficult-to-treat infections in both humans and animals. In an effort to manage the situation, Europe no longer allows the use of antibiotics to prevent illness in animals, even those that live among sick ones – they can only be used to treat sick animals. But even beyond the concern of resistance, antibiotics are a worrisome solution to illness treatment as they have far-ranging effects beyond killing the pathogen. As Alain Wille, CEO of biotech company Animab explains, “Treating with antimicrobials not only treats the pathogen, but also affects the microbiome, the healthy environment of our gut, which consists of many different bacteria. A broad-spectrum antibiotic would also wipe that out, which is dangerous as it plays an important role in overall health for animals, just as it does with humans.”

In animals raised as livestock, antibiotics are most often given during a period known as the ‘immunity gap’ when they are highly vulnerable to infection. This is when they are still too young to have fully developed their own immune system (active protection), but have started eating solid food and are no longer receiving antibodies from their mother’s milk (passive protection).

Accounting for animal welfare

“There is a delay between vaccination and being protected. But if you get antibodies directly, you have immediate protection just as you would after an effective vaccination. This is passive immunity.” – Alain Wille, Animab

Wille started his career as a veterinarian but has been working with pharmaceutical and biotech companies on animal health solutions for the past 30 years. In 2020, he started Animab alongside Vikram Virdi, now Animab’s Scientific Director, with the intention of offering an effective and gentle way of protecting animal health during the immunity gap stage. Animab’s solution is ingestible monoclonal antibodies, which can be given orally either in water or in the animals’ feed.

But why bother developing antibodies rather than a vaccine, which has been a standard treatment for decades? The short answer is that antibodies can provide protection much sooner than a vaccine. Wille elaborates: “There is a delay between vaccination and being protected. For example, with the COVID vaccine, it’s about four weeks before you’re protected – between vaccination and the onset of immunity. So, during this period you can be infected and become sick. But if you get antibodies directly, you have immediate protection just as you would after an effective vaccination. This is passive immunity.”

This immediate protection means that young animals are shielded against painful and distressing illnesses, such as diarrhea, during this immunity gap, improving their quality of life. In addition, oral administration makes it easier to protect the animals without interfering with their regular routine.

Animab’s lead product in development targets ETEC (enterotoxogenic E. coli), which causes diarrhea in pigs. The bacteria adhere to the cells lining the intestines and excrete a toxin, which is what makes the pigs ill. Animab has selected antibodies which target the fimbriae (the hair-like structures on the outside of the bacteria), to block them from adhering to the pig’s cells. They then clump together and are flushed out of the body. So these antibodies function by effectively removing the bacteria without killing them. The benefit of this is the animals are exposed to the pathogen which primes them to generate an immune response if they meet it again. It also means that there is less selective pressure on the bacteria, so there is less risk of resistance being developed (as happens when antibiotics are given).

Animab team: (L to R) Gitte Michielsen, Vikram Virdi, Nesya Goris, Alain Wille, Katarina Koruza

As easy as fermentation

These monoclonal antibodies are easy to generate on a large scale using Animab’s production platform, which uses fermentation technology. All that is needed is yeast, sugar, water, and vitamins. It is much more straight forward than vaccine production, which most of the time requires raw materials from animal origin such as mammalian cells. It is therefore also easier to scale up antibody production.

The simplicity of the platform also contributes to its versatility. “We can develop it for different diseases, different pathogens, and then we can broaden the protection from bacteria to viruses, and from pigs to other species,” says Wille. “So this technology is very promising, with multiple applications in different species.”

“We are reaching the limits of what we can do with biosecurity, with new vaccines. This is why our technology is so important and makes such a difference in the future of raising animals.” – Alain Wille, Animab

The platform and the products could not have been developed without the help of a number of partners. The Flemish Institute for Biotechnology (VIB), Vrije Unversiteit Brussel (VUB) and the University of Ghent have all been involved in the research for Animab’s antibody platform. There are also several dedicated investors who strongly support Animab’s approach for the future of disease treatment.

This new treatment is coming at just the right time: it is critical to shift away from the current protection standards. As Wille puts it, “We are reaching the limits of what we can do with biosecurity, with new vaccines. This is why our technology is so important and makes such a difference in the future of raising animals.”

Stepping into the role of a Chief Executive Officer (CEO) for the first time can be a daunting prospect. In the biotech industry, the journey is marked by a unique set of hurdles, from scientific complexities, to regulatory intricacies, finance, HR, and interactions with a wide range of stakeholders. In this dynamic landscape, the role of the Chair of the Board of Directors becomes pivotal. The Chair is well-positioned to empower and support first-time CEOs, but good synergy between the duo is paramount for success.

Supporting a visionary strategy

The CEO is the highest-ranking executive responsible for the overall management of the company. They steer the organization’s day-to-day operations, formulate business strategies, and drive innovation. By contrast, the Chair of the Board holds a pivotal position in corporate governance, overseeing the board’s functioning, setting the agenda, and ensuring alignment between the Board and executive management.

The successful synergy between the CEO and Chair begins with a shared vision for the company. In biotech – where ground-breaking scientific discoveries meet entrepreneurial challenges – a unified strategic direction is indispensable. With their industry knowledge, the CEO often provides insights into emerging trends, technological advancements, and potential growth areas. By unifying these, the CEO sets the company course with a strategic vision. In a complementary role, the Chair draws on their experience to support the CEO’s mission with tried-and-true tactics, also ensuring it aligns with long-term shareholder interests and ethical considerations.

Providing mentorship and boosting confidence

One of the most significant ways a Chair can assist a first-time CEO is through mentorship. Experienced Chairs bring a wealth of industry knowledge, leadership insights, and a network of valuable contacts. By offering guidance and sharing their experiences, a Chair can help CEOs navigate unfamiliar territories, make informed decisions, and avoid common pitfalls. The Chair can also serve as a sounding board for the CEOs, providing them with a sparring partner with which to discuss ideas, concerns, and tactical or strategic dilemmas. This mentorship not only enhances the CEO’s decision-making capabilities but also instils confidence, empowering them to lead the organization with conviction. This is particularly valuable for first-time CEOs who are often up against challenges that the management of competing companies have seen dozens of times.

Investors are more likely to support a company where the CEO and Chair work synergistically, demonstrating a shared vision and cohesive leadership.

Chairs can also support first-time CEOs in the lead-up to future investment rounds. Securing funding is a constant challenge for biotech start-ups, and good Chairs – with their credibility and industry reputation – can significantly enhance investor confidence in the company. Their endorsement of the CEO’s vision and strategy can instil trust among investors, making it easier for the company to attract funding for future research, development, and growth. It’s important to note that no matter the relationship, stakeholders – including investors, partners, regulatory bodies, and the broader scientific community – will closely observe the dynamics between these two influential figures. A harmonious and collaborative relationship fosters confidence, reinforcing the company’s credibility and reputation among stakeholders. Investors are more likely to support a company where the CEO and Chair work synergistically, demonstrating a shared vision and cohesive leadership.

Encouraging a culture of innovation and collaboration

Biotech companies thrive on cutting-edge research and development, and the Chair can help by endorsing the culture of innovation built by the CEO. With their backing, the CEO has the support to explore unconventional ideas, take calculated risks, and pursue ambitious scientific endeavors. By supporting an environment where creativity is celebrated, the Chair can help contribute to the company’s competitiveness and growth.

Together, Chair and CEO navigate uncharted waters, transforming challenges into opportunities and shaping the future of biotech innovation.

Of course, it will never be all smooth sailing in biotech, which is why conflict resolution, communication, and harmonious board dynamics are essential for the success of any company in the industry. Here again, the Chair has an important role to play, drawing on their experience in Board management to mediate conflicts, facilitate productive discussions, and ensure that diverse opinions are heard and respected. By nurturing a collaborative atmosphere, Chairs help first-time CEOs harness the collective wisdom of the Board, leading to better-informed decisions and strategic initiatives for the company.

An essential partnership for company success

In the challenging terrain of the biotech industry, a good collaboration between a Chair and a first-time CEO is not just beneficial – it is essential. The Chair’s guidance, strategic know-how, and industry influence empower the CEO to set a visionary course, overcome obstacles, make informed decisions, and drive the company towards innovation and success. As mentors and enablers, the Chair plays a pivotal role in shaping the next generation of biotech leaders, ensuring that the industry continues to flourish with ground-breaking discoveries and advancements. Together, Chair and CEO navigate uncharted waters, transforming challenges into opportunities and shaping the future of biotech innovation.

In the past, we have written on how to build the right team for start-up success. Although it is the CEO who runs the company, the Chair is also a part of this team, and it’s essential that the relationship between the pair is built on mutual trust and respect. Finding the right match is an important endeavor where the VC investors can – and should – play a role. VCs can further assist this process by tapping into their networks to assign an experienced, independent Chair of the Board as soon as possible. With a good fit between CEO and Chair, investors can help to create the tandem dynamic required for speed and success in a biotech start-up.

It’s been a Barbie world this summer with crowds of pink-clad moviegoers flooding the cinemas. Simultaneously, we’ve been witnessing a rush of ‘pink’ fundraising for women’s health start-ups. From pre-clinical to clinical: more companies are entering the field and developing solutions for women’s unique needs. But is their focus broad and innovative enough? And are pharma companies paying attention?

Historically, women’s health concerns have often been overlooked or underestimated, leading to gaps in research, diagnosis, and fewer treatments for female-specific conditions. Our understanding of sex-specific responses to treatments has been further deepened by the historical underrepresentation of women in clinical trials. Men and women differ in the way they metabolize and process drugs, as pharmacokinetics in women are often affected by lower body weight, different hormones, slower gastrointestinal motility, less intestinal enzymatic activity, and slower kidney function. The historic bias against female clinical trial participants has therefore led to many treatments being less effective or having specific side-effects in women. An example is Sanofi’s sleep medication containing zolpidem, where the recommended dose for women was corrected as it was belatedly found to be too high for women.

Despite these shortcomings, the women’s health sector has gained significant momentum in the few past years, with remarkable breakthroughs and novel applications being introduced that are tailored to women’s unique physiology and healthcare requirements. These advances are starting to extend beyond fertility and pregnancy, embracing a wider range of women’s health issues including conditions primarily affecting women (such as endometriosis, polycystic ovarian syndrome, menopause, and ovarian cancer), conditions that affect women differently to men (such as cardiovascular disease, pelvic health, and thyroid disorders), or in disproportionate numbers (such as Alzheimer’s Disease, osteoporosis, coronary heart disease, migraine, and multiple sclerosis).

Not a niche field

The historic sidelining of women’s health as a ‘niche’ field is in stark contrast with reality. Women outnumber men on earth, and the market size for women’s health is starting to reflect this fact, displaying an immense growth potential: the global femtech market alone is projected to exceed USD 60 billion by 2027. This growth is in part being brought about by the increasing public awareness of women’s health which has skyrocketed in past years, leading to improved diagnosis of conditions that previously would have remained undiagnosed or ignored. Other contributing factors include rising infertility rates across the world, as well as the increased wealth and education of women who are now in a position to prioritize and spend more on their healthcare.

This burgeoning market has gained substantial attention from technology companies and entrepreneurs. However, despite the rapid expansion of the women’s health industry, ‘me-too’ solutions currently dominate the landscape, which could benefit greatly from more innovation approaches and foci. Existing women’s health products are predominantly wearable technologies, period-tracking apps, telehealth services, personalized treatments, access to health coaches, monitoring of post-partum depression, and over-the-counter products for women undergoing hormonal changes. These advances are necessary for improving awareness and diagnosis, and play an important role in facilitating the enrolment of women in clinical trials for biotech solutions that address these indications. But when delving a little deeper into the developments of women’s health therapeutics, it is easy to see that the advances have been very gradual and some indications (including those related to fertility and menstruation) have to-date received far more attention than others. It is high time that women’s health started looking beyond the uterus, developing truly innovative solutions for the whole female body.

The beginnings of progress

There are numerous initiatives starting up to advance women’s health innovation, from national policies such as the UK Women’s Health Strategy, to actions by incubators such as the BioInnovation Institute’s Women’s Health Initiative and charities such as the Bill and Melinda Gates foundation Global Grand Challenge, and many more. This growing support is contributing to the increasing number of women’s health start-ups that have been founded in recent years. It is also driving tangible progress for patients in a range of indications.

Perhaps the best evidence for the impact of women’s health progress can be found in the higher survival rates for breast cancer patients in recent years, largely thanks to improved diagnostics, innovative systemic treatments, and therapies based on the molecular characterization of the tumor. Another area that has seen a lot of innovation is stress urinary incompetence, with approaches ranging from sling surgeries to cell therapies such as MUVON Therapeutics and MyoPax, and RNA therapies being developed by Versameb. Unfortunately, progress has not been equal across all women’s health indications: with endometriosis, for example, significant advances have been made in awareness and diagnosis, but treatment options are still lacking (though some are currently in development).

Empowering women’s health

The progress in this field is not going unnoticed by pharmaceutical companies, though their appetite for participation has not yet been spectacular. Bayer recently announced it was moving away from women’s health in a strategic overhaul. Meanwhile, things are looking a bit brighter for companies such as Pfizer, Novartis, Eli Lilly, Amgen, Merck, and AbbVie, which all have a significant presence in the women’s health market. All the above are leveraging their expertise to develop innovative solutions for a range of women’s health issues, expanding their research and development efforts to provide better treatments. The M&A space has also been quite active: Organon (a Merck spin off) acquired Forendo pharma and its clinical-stage asset for endometriosis in 2021; Sumitovant acquired Myovant with approved drugs for uterine fibroids, endometriosis, and infertility in 2022; and Astellas acquired the Belgium-based biotech Ogeda for its nonhormonal treatment for menopausal hot flashes in 2017. In early 2023, Ferring – a leader in reproductive medicine and maternal health – announced that it had entered a strategic collaboration with the BioInnovation Institute (BII) to accelerate innovation in women’s health.

In terms of funding, VCs invested USD 2 billion in femtech startups in 2021, and USD 1 billion in 2021. This year, women’s health start-ups are still managing to close multimillion-dollar rounds, despite the generally challenging VC climate. Just to name a few 2023 examples: Pomelo Care raised USD 33 million in Seed and Series A rounds led by Andreessen Horowitz for its virtual maternity care program, and Caraway Health raised almost USD 17 million in a Series A round led by Maveron and GV (formerly Google Ventures) for its digital platform for health services. There remains a significant investment gap between the US and the rest of the world, although Europe is playing an important role in the women’s health industry, with EU countries accounting for five of the top nine countries for femtech funding, and Belgium listed as number four overall (after the US, UK, and Israel).

There’s clearly action brewing in the field, even if we have yet to see enough solutions hit the market. Despite the growing appetite from pharma companies, many of the emerging start-ups in this field remain underfunded. What we now need is for enterprising investors to inject more funds into the early-stage companies with truly innovative tech and therapies, supporting a diverse range of start-ups for broader coverage of women’s health issues. At V-Bio Ventures, we are enthused by the progress in this field and are ourselves carefully looking for companies developing solutions to address women’s unique needs and help transform the landscape of women’s healthcare.

Note: In this article we aim to be gender inclusive, using the words ‘woman’ and ‘female’ to denote anyone who identifies as such.

Muna Therapeutics is developing transformative therapies for neurodegenerative diseases. These drugs aim to preserve cognition and enhance the brain’s resilience in diseases like Alzheimer’s and Parkinson’s, providing much-needed hope for millions of patients and their loved ones.

Header image: Anders Hinsby, Chief Operating Officer; Jakob Busch-Petersen, Chief Development Officer; Rita Balice-Gordon, CEO; Niels Plath, Chief Scientific Officer (courtesy of Muna Therapeutics)

Muna means ‘to remember’ in Old Norse – an ability that is vital to our sense of identity and independence. The loss of this capacity presents a heartbreaking challenge for the many people in the world living with neurodegenerative diseases, as well as for their caregivers and families. Muna Therapeutics aims to bring hope to these patients with therapies for diseases such as Alzheimer’s, Parkinson’s, and Multiple Sclerosis. The multinational biotech – based in Denmark, Belgium, and the United States – was founded in 2020, rooted in the science of two world-class labs – Dr. Bart De Strooper of VIB and KU Leuven, and Dr. Simon Glerup of Aarhus University. Dr. Rita Balice-Gordon, Muna’s CEO, explains the company’s mission: “We are dedicated to using our science to change people’s lives for the better. Our goal is to change the treatment paradigm for patients with diseases that affect memory and cognition, which form the essence of who we are as people. We want our medicines to allow people to live their best lives for as long as they can.”

“We are dedicated to using our science to change people’s lives for the better. Our goal is to change the treatment paradigm for patients with diseases that affect memory and cognition, which form the essence of who we are as people.” – Rita Balice-Gordon

Age is the single most significant risk factor for memory loss. Due to increasing life expectancies and rapidly aging populations, neurodegenerative diseases are on the rise, predicted to become a major societal burden for many countries in the coming decades. “As the population ages, these diseases are becoming a significant global healthcare issue,” Balice-Gordon explains. “If dementia were a country, it would be one of the world’s largest economies. Estimates of dementia care costs are currently upwards of several trillion dollars in Europe and the US alone. These diseases present an enormous economic and healthcare burden, with severe unmet needs for patients with no options for disease-modifying therapies.”

“If dementia were a country, it would be one of the world’s largest economies.” – Rita Balice-Gordon

A rocky road

Neurodegenerative diseases have a poor reputation in biotech and pharma as being notoriously difficult to obtain positive ‘proof of concept’ in clinical trials, a necessary step in bringing a medicine to the market. The field is littered with high-profile clinical failures and controversies, although substantial advances have been made in the past few years. These include the approval of two therapies for Alzheimer’s disease: Aduhelm and Leqembi, both drugs by Biogen and Eisai. Balice-Gordon has a positive outlook on the future. “We’re working and living through a wonderful era of promise,” she says. “Two therapies were recently approved and there are several others in development which should be on the market within a few years. These are all medicines that reduce the burden of misfolded proteins in the brain, keeping neural cells healthier for longer. This approach works, though the effect on cognitive improvement is quite modest. However, even this modest first step has generated a lot of interest in companies like Muna, which are developing the next generation of disease-modifying therapies, which can be used either as standalone medicines or as combination therapies with other approved treatments. With such high unmet needs, there’s a lot of room for continued improvement and new approaches.”

“We have two drug discovery programs that aim to boost the good functions of microglial cells while also suppressing the bad.” – Rita Balice-Gordon

Muna is using an innovative all-in-human drug discovery platform to identify and validate small molecules that can be used to repair neuronal dysfunction, resolve neuroinflammation, and restore neuroprotection and resilience to disease. Unlike the few treatments currently approved, Muna is developing drugs that target a specific type of brain cells called microglia. These cells, which are related to peripheral immune cells, have an important role to play in clearing misfolded proteins, but are also implicated in sustained inflammatory responses which worsen pathology. “We have two drug discovery programs that aim to boost the good functions of microglial cells while also suppressing the bad,” Balice-Gordon explains. “Our most advanced program is a TREM2 agonist for early-stage Alzheimer’s disease. We know from genetic studies in humans that loss of function in the TREM2 gene is a significant risk factor for neurodegenerative diseases. This is why we’re working to create potential drugs to boost TREM2 function – a potent, selective small molecule which will be entering clinical trials next year.”

Muna’s second program is targeting a potassium channel in microglia called Kv1.3, a master regulator of the damaging inflammatory response in the brain and in the periphery. “It has been a tremendous challenge to find a molecule which only blocks Kv1.3 (and not Kv1.1 or 1.2, etc.),” Balice-Gordon admits. “But using our in-house structural biology and protein chemistry expertise, we’ve been able to identify highly selective compounds which are also beautifully brain-exposed and potent blockers of Kv1.3. We’ll be finalizing the clinical candidate for this program early next year and move into clinical testing in 2025. We’re really looking forward to becoming a clinical-stage company and bringing our drugs one step closer to the patients who need them.”

Faith in the future

Interest in Muna’s approach is clearly high: the company raised a stellar €60 million Series A funding round in 2021 from an international syndicate of seven US and EU investors, including V-Bio Ventures. The startup has since received a further €4.6 million grant from the Michael J. Fox Foundation for Parkinson’s Research. Now, Muna is initiating a Series B funding round to bring its clinical programs through Phase I and II trials. “It’s a very exciting time,” Balice-Gordon enthuses, clearly proud of her team’s achievements. “Leading this team is a privilege, both professionally and personally. This group of hardworking and passionate people are all incredibly committed to Muna’s mission of creating transformative therapeutics for neurodegenerative diseases, and they’re a joy to work with. It has been a wonderful journey for me from academia to industry, and I am so grateful for the support of our team, our investors, and our Board.”

“At some point, we will all be either patients or caregivers. But as researchers and drug developers, we are in the business of hope.” – Rita Balice-Gordon

Balice-Gordon is undeterred by the challenging nature of her field. “Ours is a path that’s been paved by many failures.” she muses. “Despite the many setbacks, recent progress gives me confidence that we’ve turned the corner on this long-standing burden of failure in neurodegenerative diseases. We’re now in a new era of successes that patients can leverage, together with their caregivers and their physicians, to come up with the best treatment regime for them. We want Muna to be part of an ecosystem that offers patients great options to enhance their quality of life for as long as possible. At some point, we will all be either patients or caregivers. But as researchers and drug developers, we are in the business of hope. When my mother asks me to remind her what it is we do at Muna, this is what I tell her: at the end of the day, we provide hope for patients facing the daunting challenge of memory loss.”

Agomab Therapeutics NV (‘Agomab’) today announced the closing of a $100 million (€94.9 million) Series C financing round led by Fidelity Management & Research Company, with participation from new investors EQT Life Sciences (EQT), Canaan, Dawn Biopharma, a platform controlled by KKR, and existing investors.

— Round led by Fidelity Management & Research Company with participation from new investors EQT Life Sciences, Canaan and Dawn Biopharma, a platform controlled by KKR, as well as existing investors –

— Proceeds will support clinical Phase 2 stage lead candidate AGMB-129 for Fibrostenosing Crohn’s Disease and the development of a highly innovative pipeline of anti-fibrotic and regenerative therapies, including AGMB-447 for idiopathic pulmonary fibrosis and AGMB-101 and AGMB-102 for inflammatory and fibrotic indications –

Ghent, Belgium, October 11, 2023 – Agomab Therapeutics NV (‘Agomab’) today announced the closing of a $100 million (€94.9 million) Series C financing round led by Fidelity Management & Research Company, with participation from new investors EQT Life Sciences (EQT), Canaan, Dawn Biopharma, a platform controlled by KKR, and existing investors.

The new capital from the Series C financing will support the recently announced STENOVA Phase 2a clinical trial evaluating Agomab’s lead candidate AGMB-129, a gut-restricted small molecule inhibitor of ALK5, in patients with Fibrostenosing Crohn’s Disease (FSCD). In parallel to the start of Ph2a, AGMB-129 was also granted U.S. FDA Fast Track designation. Fibrotic strictures occur in up to 50% of Crohn’s Disease patients and are the leading cause of bowel resection surgery, however there are no approved therapies for FSCD. Earlier this year, Agomab announced positive Phase 1 results showing that single- and multiple-dose oral AGMB-129 was safe and well-tolerated at all doses tested and confirming gastro-intestinal (GI)-restricted exposure.

In addition, the proceeds will be used to advance and expand Agomab’s portfolio of growth factor-targeting drug candidates, including AGMB-447, a Phase 1-ready small molecule lung-restricted inhibitor of ALK5 for the treatment of Idiopathic Pulmonary Fibrosis and AGMB-101 and AGMB-102, cMET agonistic antibodies for the treatment of fibrotic and degenerative disorders. The proceeds will also enable strategic expansion of the organization and fund general corporate purposes.

As part of the Series C funding round, Felice Verduyn – van Weegen, representing EQT, will join Agomab’s Board of Directors, while Iyona Rajkomar, representing Dawn Biopharma, a platform controlled by KKR, and Colleen Cuffaro, representing Canaan, will join as Board Observers.

“With the addition of these world-class investors we continue to build the company as a leader in the field of fibrosis and have secured the funding required to conduct clinical studies for multiple drug candidates,” said Tim Knotnerus, Chief Executive Officer at Agomab Therapeutics. “I am very pleased to be able to work with the new board to further develop our potentially game-changing therapeutics for the many patients in high need for anti-fibrotic therapies.”

“We have followed Tim and the team for years and believe that this is the right moment to join the company’s journey,” added Felice Verduyn – van Weegen, Partner at EQT Life Sciences. “We are very impressed by Agomab’s scientific approach, strong team and mission to discover and develop drug candidates for fibrotic diseases, which remain underserved by current treatments available.”

Agomab is translating a deep expertise in growth factor biology to pioneer and develop novel treatments that aim to resolve fibrosis, repair tissue structure, and restore organ function. By combining new scientific insights with robust drug development and a long-term corporate vision, we are building a broad clinical pipeline of differentiated programs with disease modifying potential in fibrotic diseases.

Agomab’s pipeline of growth factor targeting antibodies and small molecule compounds includes its lead candidate AGMB-129, a gastrointestinal tract restricted ALK5 inhibitor for which it has recently started a Phase 2a clinical trial in Fibrostenosing Crohn’s Disease and received U.S. FDA Fast Track Designation. The second TGFß targeting pipeline candidate, AGMB-447, is a Phase-1-ready lung-restricted ALK5-inhibitor for treatment of idiopathic pulmonary fibrosis. AGMB-101 is an HGF-mimetic cMET receptor agonist in IND-enabling development for the treatment of fibrotic disorders. https://agomab.com/

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life sciences companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. To learn more, please visit www.v-bio.ventures

After an exceptional sequence of socio-economic shocks over the past few years, the number of new companies being formed in key European biotech hubs has stalled. Early-stage investors need to roll up their sleeves and help to crank the engine of EU innovation back to life.

The biotechnology industry has seen remarkable growth and progress over the past few years, with numerous startups making a big impact. We have seen the contributions made during the COVID pandemic, where vaccines and COVID treatments developed by biotech companies had a monumental impact on global health. Furthermore we have seen advancement in areas like cell and gene therapy, neurology, and precision oncology, and more.

With Venture Capital (VC) investments financing innovative therapies that address unmet needs, the biotech industry will make lasting changes that can help overcome some of the societal healthcare challenges. We all hope that in the future, biopharma may be able to not only treat but also cure more common diseases and prevent others, as well as making access to better treatments available for larger group of patients.

However, the long-term future of our biotech industry can only be guaranteed if we manage to replenish the scene with new players bringing along novel ideas and approaches. Over the last years we have lived through an exceptional sequence of socio-economic shocks, with the coronavirus pandemic, the supply chain crisis, and the ongoing Russian invasion of Ukraine. These events compelled us to look under the hood of European biotech and ascertain whether the motor of innovation is still running.

Company creation has stalled

In order to investigate the matter objectively, we took a deeper look at the data on the number of new companies (NewCos) that were established of the past years in some of the key European biotech hubs. The data were extracted from BCIQ (a biotech business intelligence database curated by BioCentury) by querying for companies founded in a specific year.

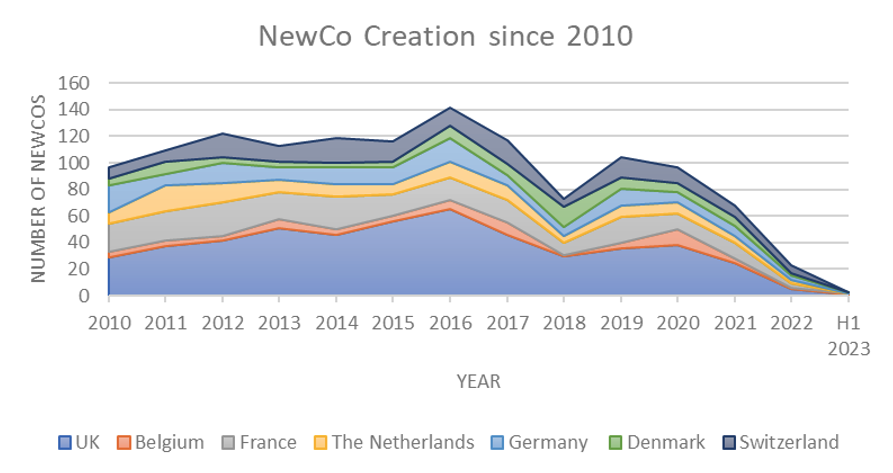

Figure: New company (NewCo) creation in European biotech hubs 2010 – 2023 (V-Bio proprietary data, generated using Biocentury BCIQ, 18 July 2023)

The data on NewCo creation in the larger European Biotech hubs (Belgium, France, The Netherlands, Germany, Denmark, Switzerland, and the UK) show a slight increase in the number of biotech companies founded every year during from 2010 to 2016. However, from 2017 NewCo creation is clearly trending downwards. There was a dip in 2018 at the start of the bear market in stocks, whereafter NewCo creation picked up again in 2019 and 2020. Admittingly the numbers didn’t reach the highs of the years preceding the crash, but considering the ongoing pandemic and country-wide lockdowns it all still looked hopeful.

And yet, hope seems to have foundered since then: looking at NewCo creation over the past two years, we should speak of a standstill rather than a slowdown. We are looking forward to seeing the end-of-year data for 2023, which might brighten the picture a little bit. Currently, it seems the motor of NewCo creation in Europe has stalled.

Less power for early-stage startups

This current dearth in NewCo creation in key European biotech hubs will have a knock-on effect over the coming years. Every time a NewCo is created it further enables the development of a technology or product which otherwise was not possible, whether at the academic research institute or the parent pharma company. As fewer biotech startups are being founded, there will likely be a decrease in the number of innovative treatments eventually reaching patients in need.

The shortage in early-stage startups will also have an impact on VCs, particularly regarding the larger pots of money now available in the European ecosystem. With fewer early-stage investment opportunities, there won’t be as many companies making it through to the Series B and C financing rounds which are sought after by the larger VC funds. Over the past years more funding has been poured into the European biotech sector, with many of the VC powerhouses creating record size successor funds in ever shorter cycles. These unprecedented fund sizes require a faster turnaround of money, which will have repercussions on the type of deals that these large funds are pursuing.

“We need watering cans, sprinklers and hoses that are appropriate to the size and scale of the companies we are growing.” – Steve Bates

With initial investment stakes of EUR 20-25 million, it will be a challenge to prioritize funding for early-stage startups and academic spin-offs which have high intrinsic attrition risks. Hence, we will likely see a tendency of the larger funds to favor later-stage investments in companies that have already identified drug candidates and are close to, or already in, clinical development.

Fueling all parts of the machine

A diversified approach to capital allocation is fundamental to ensuring the growth of the innovation sector. This thought was exemplified by Steve Bates (CEO of BIA), when he said: “We need watering cans, sprinklers and hoses that are appropriate to the size and scale of the companies we are growing.”

To build and maintain a vibrant biotech ecosystem, we need more than just larger investors investing into companies with identified therapeutic candidates. Equally important are knowledgeable investors that can roll up their sleeves and engage with entrepreneurs and research institutes to create fledgling companies, putting them into the best position for future growth and follow up financing by larger investment funds.

Dedicated early-stage life sciences investors – such as V-Bio Ventures, BioGeneration Ventures, Thuja Capital, Kurma Capital, and university seed funds – are an essential part of the ecosystem. If they can be combined with governmental initiatives supporting the high-risk initial steps of translating innovative science into products, the fundament underneath the biotech ecosystem can be preserved and strengthened.

As always, progress comes down to people: these funds need to have investment professionals with long standing expertise and network in the sector and the guts to give new inventions the chance to thrive. There are challenging yet exciting times ahead for investment managers if they are able to seize the opportunity and crank the engine of European biotech innovation.

September 20, 2023, BOSTON, MA and GHENT, Belgium – Orionis Biosciences, a privately held life sciences company with an integrated drug discovery and chemical biology platform, announced today a multi-year collaboration with Genentech, a member of the Roche Group, to discover novel small molecule medicines for challenging targets in major disease areas, including oncology and neurodegeneration. Orionis will receive an upfront payment of $47 million, as well as future milestone-related payments. Orionis will leverage its Allo-GlueTM platform for discovery of small molecule monovalent glues.

Orionis’s Allo-Glue™ platform utilizes multiple unique approaches to discover drug-like small molecules against disease targets that have remained elusive to traditional discovery approaches. The platform integrates a suite of proprietary chemical biology technologies, including biological assays, computational analyses, chemical libraries and automated processes for high throughput discovery, rational design and optimization of small molecules that promote or induce interactions of proteins in living cells. This includes molecular glues that can promote interactions leading to either target degradation (through virtually any ligase) or modulation of target function, via either direct or allosteric mechanisms. Both target-centric and ligase-driven discovery paradigms are enabled and leveraged in a synergistic manner in the company’s overall approaches to molecular glue discovery.

Under the terms of the agreement, Orionis will be responsible for the discovery and optimization of molecular glues for Genentech’s designated targets, while Genentech will be responsible for subsequent later-stage preclinical, clinical development, regulatory filing, and commercialization of such small molecules. Orionis will receive an upfront payment of $47 million and is eligible for development milestone payments, as well as commercial and net sales milestone payments that could exceed $2 billion and a tiered royalty upon sale of collaboration products.

“Molecular glues represent one of the most exciting recent developments in small-molecule drug discovery. We are thrilled to collaborate with Genentech, a company long known for its world-class science and trailblazing medicines, to make use of technological innovations that we have systematically evolved over the past years to unlock novel target space with such drug modalities” said Nikolai Kley, Co-Founder and CEO of Orionis Biosciences. “We could not be more excited about the potential for this pioneering collaboration to lead to impactful new treatment paradigms.”

Riccardo Sabatini, Orionis Chief Data Scientist, added, “It is exciting to see how synergies created by the integration of our biological, chemical and computational technologies are being leveraged for the discovery and design of molecular glues.”

“Molecular glue degraders are an exciting modality to target disease-related proteins that have proven challenging with more traditional treatment modalities,” said James Sabry, Global Head, Roche Pharma Partnering. “For patients with unmet needs, this offers a new therapeutic approach to modulate major disease drivers. This collaboration enables us to apply the concept of targeted protein degradation to discover and develop medicines for patients with serious and life-threatening diseases.”

Orionis Biosciences is a life sciences company pioneering the discovery of conditionally active drug modalities for life threatening diseases. These operate by leveraging induced molecular proximity and cooperativity mechanisms in unique fashion to gain novel target access, potency and precision. The company applies its design concepts and technological innovations to the discovery of small molecules, with a focus on monovalent molecular glues with its Allo-GlueTM platform, and to the design and engineering of novel classes of precision biologics and cytokine-based immunotherapies with its A-KineTM platform. The company is advancing a deep and diversified pipeline of drug modalities, including agents that engage components of the adaptive and innate immune systems with high precision, creating new avenues for the development of single agent-effective therapies for patients with cancer and other diseases. To learn more, please visit www.orionisbio.com.

Orionis Media Contact: Olivia Durr, Ten Bridge Communications; odurr@tenbridgecommunications.com

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life sciences companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors. To learn more, please visit www.v-bio.ventures.

Ghent, Belgium, 7 September 2023 – Corteria Pharmaceuticals, a V-Bio Ventures portfolio company, is a biopharmaceutical company specialized in the development of transformative therapies for unaddressed heart failure subpopulations. Corteria today announced an oversubscribed EUR 65 million Series A co-led by US investment firm OrbiMed and EU-based leading investment firm Jeito Capital, with the participation of all existing seed investors (V-Bio Ventures, Kurma Partners, Fountain Healthcare Partners, Invivo Capital, and Omnes Capital). The funding will be used to advance Corteria’s cardiovascular pipeline into the clinic.

Heart failure is a serious disease with a prevalence of more than 60 million patients globally and still growing. Corteria’s innovative approach consists of selecting therapeutic targets involved in the worsening and acute forms of human heart failure, as well as a stratification strategy to identify specific subgroups that are most likely to benefit from the treatments. These forms of heart failure are widespread, life-threatening, and not directly addressed by the current standards of care.

Corteria was founded in 2021 by Sanofi’s former head of cardiovascular research, Philip Janiak, and Marie-Laure Ozoux, former cardiovascular project leader at Sanofi, around two cardiovascular programs in-licensed from Sanofi[1].

Since then, Corteria’s pipeline has expanded rapidly and today comprises three first-in-class therapies that are highly differentiated as they produce multi-organ benefits, acting on the kidneys, the vessels, and the heart:

The lead asset for Worsening Heart Failure is expected to enter the clinic in early 2024.

[1] CRF2 peptide agonist and AVP neutralizing monoclonal antibody programs

[2] Corticotropin-releasing hormone receptor 2

V-Bio Ventures is an independent venture capital firm specialized in building and financing young, innovative life sciences companies. V-Bio Ventures was established in 2015 and works closely with Belgium-based VIB, one of the world’s premier life science institutes. The fund invests throughout Europe in start-up and early-stage companies with high growth potential focusing on technologies that provide transformational improvements in the biopharmaceutical, pharmaceutical, diagnostics and agricultural sectors.

Founded in 2021, Corteria Pharmaceuticals is a privately held biopharmaceutical company developing first-in-class drugs in heart failure subpopulations. Despite some improvements in the management of this serious disease, the prevalence of heart failure keeps increasing with more than 60 million patients worldwide. Corteria’s strategy implies innovative patient stratification and target selection based on human evidence and a better understanding of the disease biology in patients with a focus on worsening and acute heart failure and right heart failure.