Only one year after its inception, the life science investment fund V-Bio Ventures made its first investments in three companies and announced the final closing […]

Only one year after its inception, the life science investment fund V-Bio Ventures made its first investments in three companies and announced the final closing of their first fund. Time to discuss how V-Bio is going to put their €76 million to work!

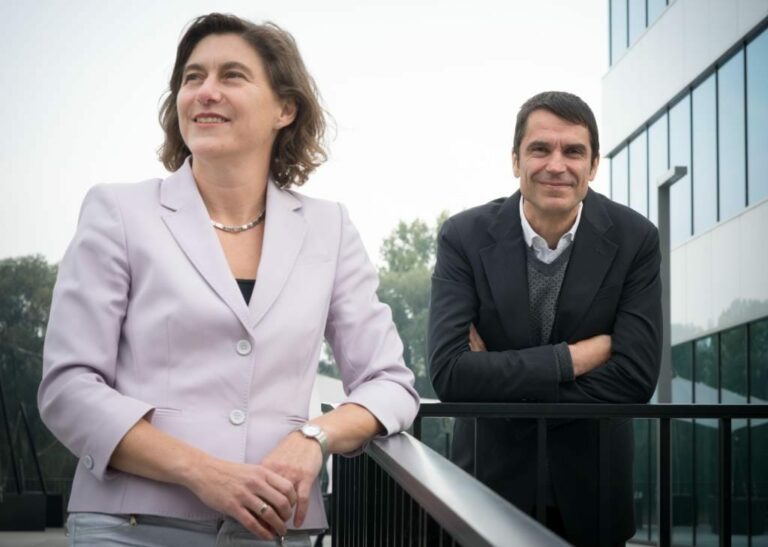

In November 2015, V-Bio Ventures announced the initial closing of its first fund. The specialized investor in early-stage life science companies had gathered €63 million from five investors. Only one year later, the fund announced its second closing, with four new investors joining the initial group. V-Bio’s proud managing partners, Christina Takke and Willem Broekaert, guide us through the fund’s first year.

Takke: “We were able to start investing from Day One and proved we could spot great opportunities. Our activities over the past year were a convincing factor for the second closing.”

We’re really excited that we were able to raise more capital than anticipated.

V-Bio manages €76 million and has cemented its position as one of the larger European early-stage funds in life sciences.

Takke: “We’re really excited that we were able to raise more capital than anticipated. Most comparable funds manage €30 to 50 million. With our fund, we can make a considerable contribution to early-stage investments and provide follow-up funding in different stages of a company’s trajectory.”

Broekaert: “The size of the fund and the sector in which you invest determine the number of companies in which you can invest. Biotech is very capital-intensive, but you still want to hold a significant stake in a portfolio company. Also, spreading of risk is an important factor. With the amount raised, we’re looking to build a portfolio of about 15 companies.”

An international view on investments

Our vision extends beyond the boundaries of VIB.

V-Bio Ventures has a close relationship with VIB; the research institute is a co-founder and minor investor in the fund. However, V-Bio doesn’t limit itself to investing in VIB spin-off companies.

Broekaert: “We have access to VIB’s proprietary pipeline of innovations early on. That is a unique position, and we are certainly building on the expertise of this world-renowned research institute. However, our vision extends beyond the boundaries of VIB.”

Takke: “We’ve built a portfolio of three companies over the last year. Confo Therapeutics and Orionis Biosciences both originated from VIB, while our third portfolio company, Oxular Ltd, was founded in the UK. These three investments show our pan-European strategy and exemplify the international attention our projects generate. We value investing in companies with different investor syndicates, and we’re proud to say that we’re the only European investor in Orionis.”

Investing is like getting married

When it comes to investing, V-Bio does a lot more than just put money on the table.

Takke: “Many funds invest in something that’s already there. We will actively help management teams build a strong company that’s also a good investment. Therefore, it’s very important that both management and investors see eye to eye and are behind all decisions 100%.”

Broekaert: “This is very important when we choose our projects. Teams need to be willing to work closely together with us, presenting all data, good and bad. Mutual trust is crucial. We are in it together, for better or for worse. Sometimes, we can get on board very early on and help to bring the management team together.

Teams need to be willing to work closely together with us, presenting all data, good and bad.

Of course, we can’t do this for every company in our portfolio. We will grow our portfolio with companies in which we’re involved from the very inception and others where we join when other investors have already stepped in.”

V-Bio reviews approximately 100 dossiers per year. Out of these, an average of approximately three projects will meet all criteria and become part of the V-Bio family. It’s a very young and dynamic team with an open-minded spirit. No time to lose, so take your shot!