Everyone in the investment business is familiar with the phenomenon of technology hypes. These trends tend to come and go like inevitable tidal waves, and it’s easy to get swept up in the furious rush. But should you go with the flow, or are you better off swimming against the tide of technology trends?

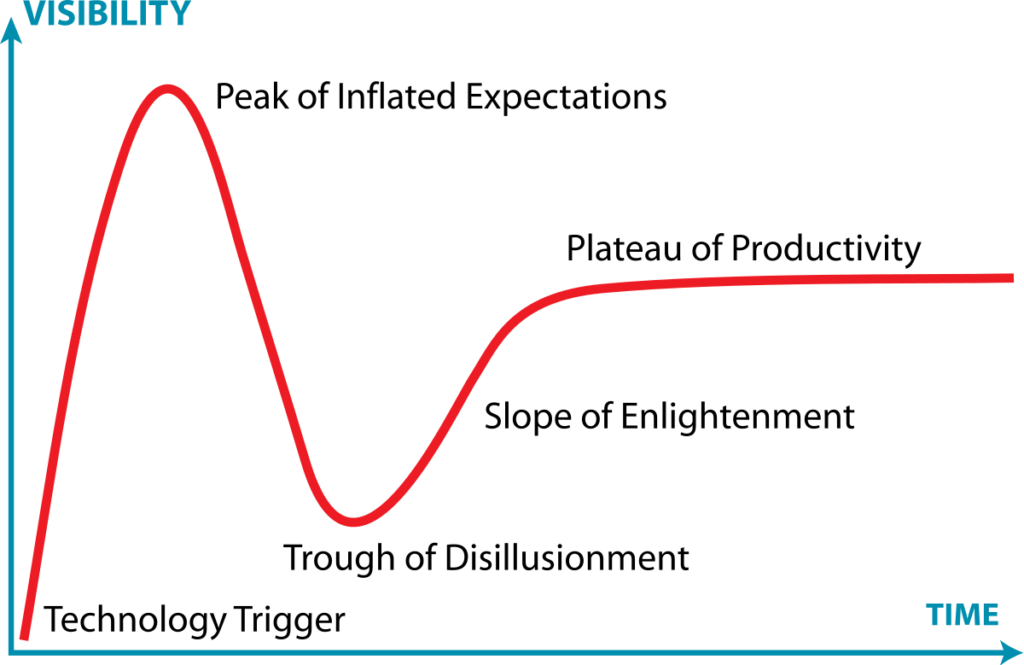

Gartner, Inc. – a consulting firm specialized in research on emerging technology trends in the IT sector – was the first to analyze how a technology hype cycle plays out. Typically, it follows a predictable pattern:

Image: Gartner Research’s Hype Cycle diagram (CC Jeremy Kemp)

Hype cycles in the life sciences

Although the Gartner Hype Cycle was initially conceived to describe trends in IT, the cycle applies to new technologies in the life sciences as well. Antibodies are a perfect example: today they are among the bestselling pharmaceutical drugs, touted for their efficacy and exquisite safety. But it wasn’t always smooth sailing. The start of the antibody hype cycle dates back to 1975, when the first monoclonal antibodies were initially generated. Unfortunately, this resulting first generation of antibody therapies came with unacceptable adverse reactions and rapidly waning therapeutic efficacy, because the antibodies were derived from mice and patient’s immune systems rejected them. It wasn’t until years later that the antibody humanization technique was perfected, and the first clinically and commercially successful drugs hit the market. The first successful humanized monoclonal antibody product Rituximab wasn’t approved by the US FDA until 1997, a full 22 years after the hype began. The monoclonal antibody space has since expanded exponentially – it is now valued at billions of euros and includes a wide range of indications such as oncology, infectious diseases, and cardiovascular conditions.

In the agriculture sector, an ongoing hype cycle was kick-started in 1999 when Dickson Despommier (a professor at New York’s Columbia University) shared his visionary ideas about vertical farming. The prospect of food production in an urban environment with reduced water usage and transport costs appealed to many – soon thereafter, investor money started pouring into the first vertical farming startups, such as AeroFarms back in 2004. AeroFarms even made it into the top 100 list of TIME magazine’s ‘Best Inventions in 2019’, yet a mere two years later, an anticipated SPAC financing had to be called off. Similarly, another high-profile VC-backed vertical farming startup called Fifth Season, founded in 2016, folded in 2022. The companies had both become victims of increased disillusion in the sector. Unlike monoclonal antibodies, vertical farming has yet to deliver on its promises. This technology still struggles with scaling complexities and high running costs, including the massive amounts of energy required to power the LED lights. Time will tell if these challenges can be overcome – vertical farming may yet become a significant contributor to our food chain, but more bankruptcies will likely occur before we reach that stage.

When is the best time to invest?

Now that we’ve identified the hype cycle pattern, what can early-stage life sciences investors learn from this? When is the best time to invest with the current trend, and when is it best to hold off?

Firstly, venture capitalists are usually attracted to the initial ascent of the hype curve. When the rumor mill starts to churn, investors often leap into action spurred on by an intense fear of missing out on a promising new technology. In their frenzy to obtain a slice of the cake, they often create even more hype, simultaneously transmitting an inflated expectation of success while downplaying potential difficulties to others. Negative as it sounds, this investment strategy may nevertheless pay off, particularly for those who manage to enter the game very early on. Often, these are investors who have pre-established links with the technology originators, and therefore learn of the breakthrough well before the buzz starts to spread. The benefit of investing with the initial startups pioneering a novel technology is that these companies are best positioned to strike lucrative deals with corporate leaders looking for new innovation. This allows the pioneering startups to fill their war chest and punch through in rougher times, while younger companies (though they likely have an easier time with initial financing thanks to the hype) struggle more when disillusionment shakes up the sector. The take-home message? It pays to keep a finger on the pulse in this industry, and get onboard very early.

“It pays to keep a finger on the pulse in this industry, and get onboard very early.” – Willem Broekaert

Interestingly, there is an alternative strategy that may also pay off: in some specific cases it can be worthwhile to invest in a company created during the hype’s descent into disillusionment or the ensuing recovery slope. These companies will often have learned from earlier setbacks and developed next-generation technologies that are better able to reach the threshold required for technical and commercial success. It is worth noting however that these startups will also face additional hurdles in raising funds, as they have to battle the negative perception caused by the failures of their earlier peers. Worth it? Potentially, but proceed with caution.

Obviously it is much easier to identify the phases of a hype cycle in hindsight than in real time, making it hard for investors who are wondering if now is the right time to invest in a trending innovation. Venture capitalists should always rigorously assess each case and situation, acknowledging that external perceptions will impact the perceived value of their investment as it moves through the hype cycle, while also bearing in mind that the most important element of success is ultimately the value of the innovation itself.